Can Someone With Dementia Sign a Will?

However, if someone you know has symptoms of dementia, it might not be too late to sign a will or other estate planning documents. [Read more…]

Can I Get Executor Fees for Handling an Estate?

In most cases, the answer is yes, you are entitled to receive executor fees for your services. However, there are some issues to consider before you can receive payment from the estate. If there is a Will, the deceased may have specified the amount of compensation or prohibited executor fees. This latter situation sometimes occurs when the executor is a family member who is also a beneficiary under the Will. If the Will is silent regarding executor fees or the deceased dies without leaving a will, then executor fees are determined by state law. This is where things may get complicated.

Consider the case of Lawrence, who was appointed the personal representative of an estate in Massachusetts where the primary asset was a house subject to a small mortgage. Lawrence sold the house, paid off the mortgage, dealt with the contents of the estate, and the assisted his attorney with court paperwork. He also made distributions to the beneficiaries. He charged the estate $7,500, what he considered a fair price for his services. When one of the beneficiaries objected to the fee, the court denied the executor fee because Lawrence did not have any records to back up his executor fees.

Unlike in some states, where the executor fees are fixed amounts equal to a percentage of the probate estate, in Massachusetts the executor is entitled to “reasonable compensation” for services rendered. The executor fees can also be subject to approval by the probate court.

What exactly is “reasonable compensation” though? How do you determine for which services you are entitled to be paid executor fees and at what rate? There are no clear guidelines under the law in Massachusetts, but the probate court will consider factors such as the size of the estate, the time reasonably required to administer the estate, whether the services rendered were reasonably necessary, and the amounts usually paid to others for similar services.

So what does all this mean in practice? Most importantly, you must keep detailed records. Do not wait until the end of the process to attempt to compile a list of services performed. You will need to disclose your executor fees in the final accounting filed with the court and/or shared with the beneficiaries. When you do, you should include:

- a detailed record of the tasks performed

- the amount of time spent on each task

- the hourly rate billed for each task.

For example, a record that lists: “February 1, 2013: 2 hours at $25/hour preparing financial statement for accountant,” along with similar entires, are more likely to be approved by the court than: “$1,000 for bookkeeping services.”

Finally, keep in mind that any executor fees you receive are considered income and are taxable. If you want to avoid tax consequences, you have the option to decline compensation for your services.

Although it is an honor to be appointed or asked to serve as an executor, it is not a situation you should take lightly. Most often having the guidance of an attorney is necessary to avoid common costly mistakes. Contact us to discuss your rights and obligations.

4 Steps to Get Your Online Accounts in Order

Have you given any thought as to what would happen to your internet presence after you pass away? With a vast majority of adults now using online services such as email and social networking sites on a regular basis, digital estate planning is becoming increasingly important. Without a plan in place, your family may not be aware of the extent of your digital assets and may not be able to access your online accounts after you’re gone.

What is a Digital Asset?

Usually when we discuss assets, we think of things that exist in solid form and have tangible value. However, in this digital age, that definition isn’t broad enough. Our digital assets can include things like digital music and books we’ve purchased, as well as artwork we might have created online. Also, any account you create on a content-sharing site like Facebook or Picasa can be considered an asset, itself.

Unfortunately, the law in this area has yet to catch up with the modern digital age. Currently, only five states have laws regulating access to a deceased person’s online accounts. Though Massachusetts is working on legislation, it has yet to enact a law.

Because of privacy concerns, online companies like Facebook and Twitter refuse to grant surviving family members access to their members’ accounts. However, some companies are trying to address this growing issue. For example, Google created the “Inactive Account Manager,” which allows users to choose what will happen to their Gmail messages or other data if their accounts become inactive.

With the state of the law uncertain, it is important to revise your estate plan to ensure that your digital assets are disposed of according to your wishes. The government now recommends that people create a social media will.

Here are some steps you can take to get your digital affairs in order.

- Inventory your digital assets: determine what digital content exists and where it is located

- Decide what should happen to each digital asset or account after you’re gone

- Designate a digital personal representative to dispose of your online assets and accounts according to your wishes

- Create a separate document containing information on how to access online accounts, including usernames and passwords (since a will is a public document, it is best not to write this information in your will)

There are also a number of websites that have sprung up recently that can help you keep track of your online data and release it to those you designate after you pass away. Some include Legacylocker.com, Assetlock.net, and Deathswitch.com.

If you have not yet made provisions for what will happen to your online presence after you’re gone, contact Attorney Kristina Vickstrom at 508-757-3800. We will review your digital assets and help you incorporate them into a comprehensive estate plan.

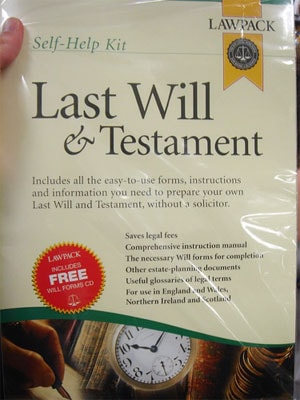

“Do It Yourself Will” Websites Panned by Consumer Reports

The magazine analyzed three such sites – LegalZoom, Rocket Lawyer, and Quicken WillMaker Plus – and ran the results by a law professor who specializes in tax and estate law. All three “do it yourself will” websites had a variety of problems, according to the study.

The problems included:

Outdated information.

Two sites applied federal tax rules that were already months out-of-date.

Not state-specific.

The law of wills varies from state to state, but the programs didn’t take into account variations in state law, including state lax law.

No tax advice.

None of the programs offered tailored advice on how to reduce taxes – a critical flaw.

Incomplete.

The websites often lacked provisions on how to handle business interests, electronic assets, trusts for children with special needs, trusts for pet care, domestic partnerships, multiple trustees, how executors are to be compensated, etc.

No flexibility.

The websites frequently made arbitrary choices and didn’t allow bequests to be handled differently. And some added additional provisions to trusts without any warning.

The professor described one will produced by Rocket Lawyer as “primitive,” and another as “a mess.”

The magazine noted that LegalZoom allows you to pay extra money to receive attorney “support,” but when it contacted the company, it was told to type questions about arbitrary or missing provisions into a box and that these would be handled later in a hard copy of the will. According to Consumer Reports, even though it paid the extra fee, this never happened.

Using a “do-it-yourself will” website to create your will can be “like removing your own appendix,” according to the Consumer Reports article.

There’s simply no substitute for a lawyer who can understand your wishes and goals, and provide legal and tax advice that’s suited to your specific needs. Although it’s best to contact us first, if you have already paid for one of these services call us today to review your will and make sure it accomplishes your goals and is appropriate for your unique situation.

Photo Credit: lukemontague

What Really Happens to Your Estate if You Die Without a Will in Massachusetts?

Dying without a Will is called dying “intestate”. What this means is that your intentions as to who inherits your assets, who administers your estate, and who acts as guardians for any young children are determined by the Commonwealth of Massachusetts. It is often said that if you don’t have an estate plan, the Commonwealth has one for you. And as of January 2nd, 2012, the Commonwealth has an updated plan for you! That’s when the last phase of the Massachusetts Uniform Probate Code (MUPC) takes effect. [Read more…]