Can you be kicked out of assisted living?

Often, the reason is that the facility believes that the resident’s condition has deteriorated to the point where it can no longer provide all the services that he or she needs. [Read more…]

How to Choose the Best Medicare Part D Drug Plan

The real cost of a Medicare Part D plan depends not only on the premium, but also on the availability of the drugs you need, your additional out-of-pocket costs, and how convenient it is to obtain your medications. [Read more…]

5 Things to Discuss Before Retirement

You may have a vision for your retirement, but does your spouse share that vision?

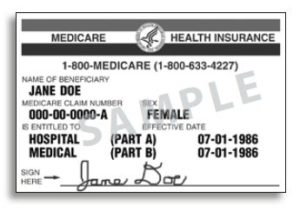

Are you getting the right Medicare coverage?

Earlier this year, the government agreed to settle a class action lawsuit over this issue. That settlement has now been approved by a federal court – and what’s more, the settlement has been made retroactive to January 18, 2011, so if you were denied coverage for services after that date, you might be able to go back and re-apply for coverage. [Read more…]

What conditions does Medicare cover

Choose Your Medicare Doctor Carefully

Under Medicare Part B, which pays for doctor visits, once your annual deductible is met, Medicare pays 80 percent of what it considers a “reasonable charge” for the item or service. You’re responsible for the other 20 percent. [Read more…]

What Happens if My Long-Term Care Insurance Fails?

But in cases where an insurance company simply fails, every state has an insurance guaranty association that protects consumers. The purpose of this association is to take over the policies of an insurance company that’s experiencing financial difficulties and ensure that claims are paid. [Read more…]

Women May Soon Pay More for Long-Term Care Insurance

Medicare Mistakes Lead to Big Penalties